KPI’s and Metric-Driven Continuous Improvement in Order-to-Cash (O2C)

Introduction

Most Accounts Receivable organizations have historically been measured on overall Accounts Receivable levels, overdue accounts, and department cost. But, in today’s challenging business climate, with companies implementing more advanced technology and end-to-end process design, there is a much more compelling need to measure and evaluate the entire Order-to-Cash (O2C) process. How to best approach this daunting task can vary based upon such factors as company structure, the type and complexity of the customer base, and the governance model overseeing the Order-to-Cash organization. Most importantly, however, is securing a strong senior leadership commitment to focus the appropriate resources on getting this performance measurement structure in place and then adjusting and enhancing as needed on a going-forward basis.

Company Experiences

A Peercast discussion in Peeriosity’s Accounts Receivable (O2C) research area featured a global company with over $5B in annual revenue discussing their approach to developing KPIs and metric-driven improvement in O2C. The company’s O2C Process Owner developed a framework for metrics that leverages Service Level Agreements (SLAs) that determine and regulate the end-to-end process key business deliverables, and Operating Level Agreements (OLAs) that determine and regulate the cross-functional key inputs to the process. Together, SLAs and OLAs are the key components of a metric-driven governance model with an end-to-end perspective.

The company uses a continuous improvement cycle with oversight from a cross-functional steering committee and Global Process Owners. The key steps in the cycle include defining SLA and OLA content, defining and implementing shared KPIs, reviewing performance versus target, analyzing gaps, identifying improvement opportunities, implementing corrective action, assessing achieved benefits, sharing best practices and benchmarking, followed by repeating the cycle from the first step; defining SLA and OLA content.

For more details about their experience in creating end-to-end KPIs and metrics to drive continuous improvement in the Order-to-Cash process, Peeriosity-100 members are encouraged to review the full presentation and listen to the Peercast recording in the Accounts Receivable (O2C) research area.

Polling Results Review

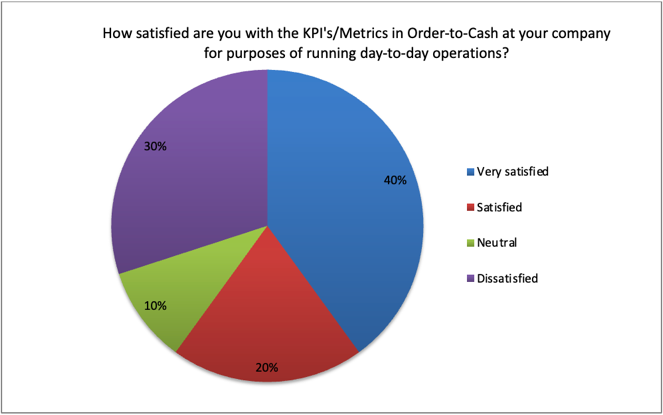

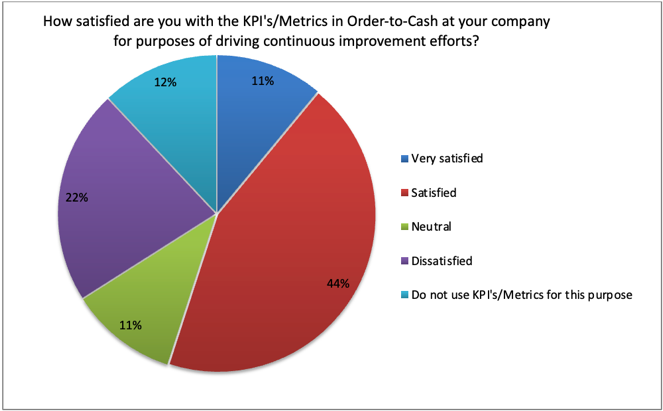

To support the Peercast, a poll was created to understand how satisfied Peeriosity-100 member companies are with their KPI’s and metrics to run day-to-day operations, and their KPI’s and metrics used to drive continuous improvement efforts.

The first poll question asked about satisfaction with KPI’s and metrics to run day-to-day operations. The results indicate that 40% are very satisfied, 20% are satisfied, 10% are neutral, and 30% are unsatisfied.

The second poll question asked about satisfaction with KPI’s and metrics to drive continuous improvement efforts. This task appears to be more challenging, with only 11% indicating that they are very satisfied, 44% who are satisfied, 11% who are neutral, 22% who are dissatisfied, and 12% who indicate that they don’t use KPI’s or Metrics for this purpose.

Here are some of the comments from Peeriosity-100 members:

- We have robust reporting and analytical tools that enable us to identify payment outliers, exceptions, etc…

- We have a developed KPI framework in place leveraging Celonis capabilities.

- We need better deduction metrics, and we are currently working on this.

Closing Summary

With the increased prominence of the Order-to-Cash organization as the result of consolidation, global process ownership, and the application of advanced technologies comes the responsibility of providing enhanced operational transparency to key stakeholders. As was well demonstrated by our feature company, through a focused application of the right resources a well-balanced and highly-effective performance measurement program can be designed and implemented in a reasonable period of time. The keys to success are to make this a high priority and to ensure the needs of the variety of customers and stakeholders are met through the proper measures and results reporting.

What is the status at your company regarding the current ability to effectively report the performance of the Order-to-Cash process area? Are the information needs of your employees, key internal customers, and stakeholders being met?

Who are your peers and how are you collaborating with them?

__________________________________________________________________________

“Peercasts” are private, professionally facilitated webcasts that feature leading member company experiences on specific topics as a catalyst for broader discussion. Access is available exclusively to Peeriosity member company employees, with consultants or vendors prohibited from attending or accessing discussion content. Members can see who is registered to attend in advance, with discussion recordings, supporting polls, and presentation materials online and available whenever convenient for the member. Using Peeriosity’s integrated email system, Peer Mail, attendees can easily communicate at any time with other attending peers by selecting them from the list of registered attendees.

“iPolling” is available exclusively to Peeriosity member company employees, with consultants or vendors prohibited from participating or accessing content. Members have full visibility to all respondents and their comments. Using Peeriosity’s integrated email system, Peer Mail, members can easily communicate at any time with others who participated in iPolling.

Peeriosity members are invited to log into www.peeriosity.com to join the discussion and connect with Peers. Membership is for practitioners only, with no consultants or vendors permitted. To learn more about Peeriosity, click here.